This article was originally produced in conjunction with Boring Money for their Investment Trust Hub.

Some information contained herein has been obtained from third party sources and has not been independently verified by Polar Capital. Neither Polar Capital nor any other party involved makes any express or implied warranties or representations.

Almost five years on from Covid-19, the momentum that drove hordes of investors into healthcare stocks during the pandemic seems to be well and truly behind us. In its place, however, is a new generation of treatments and technologies, spanning from weight loss injections to AI-led cancer screening, and a burgeoning revolution in the insurance scene, all setting the stage for a long-awaited bull market in healthcare.

Healthcare stocks show signs of recovery in 2024

According to analysis by the World Economic Forum (WEF), the global healthcare market is worth $9 trillion and, as at 2024, makes up 11% of the world's GDP. This goliath sector may not be as popular with retail investors as the ever-exciting field of technology, for example, but its universal relevance makes it one of the largest and most interesting markets to explore.

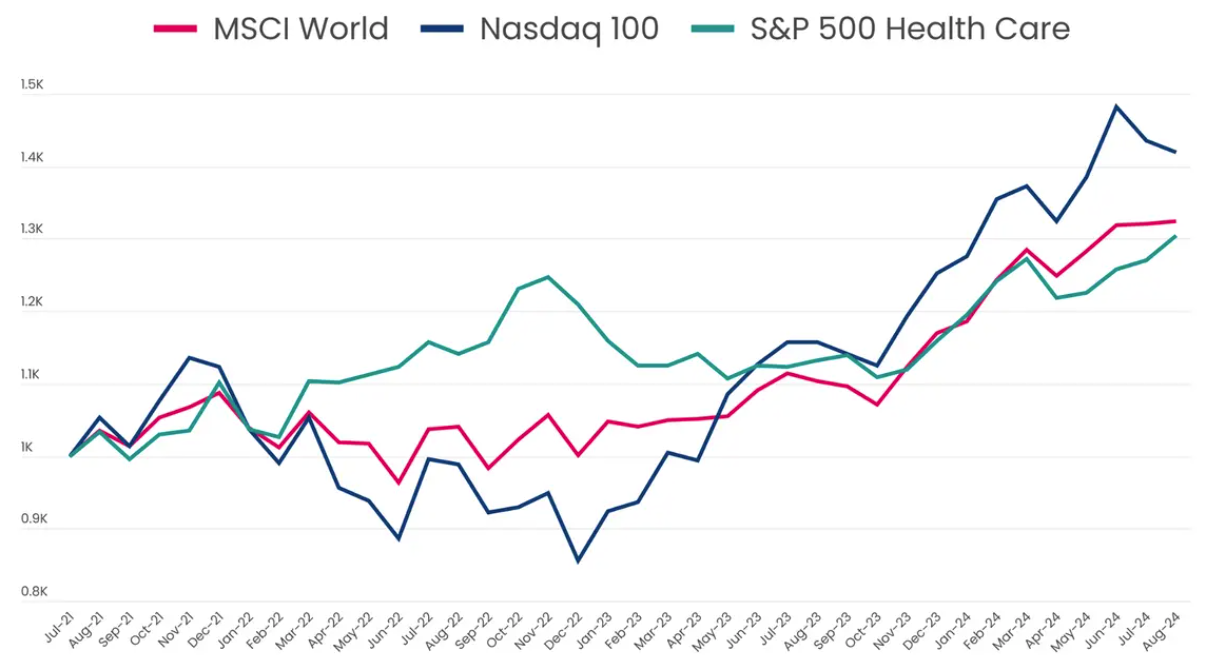

Many headline-grabbing stories from the past couple of years can be attributed to technology stocks and, more specifically, the hype around AI advancements. The unprecedented level of interest drove a so-called “tech boom” and saw returns exceed those of other sectors across 2023. Healthcare, on the other hand, lagged behind – particularly during the summer months at a time when technology stocks were beginning a rapid uphill trajectory.

However, over the course of 2024, healthcare returns have climbed back up. Though still lagging the overall market, analysts increasingly believe the sector retains strong foundations and may even be poised to enter a bull market in the near future.

Exhibit 1: Although healthcare performance dipped during 2023, the sector has regained momentum in 2024 Comparing performance of £1,000 lump sum investment into MSCI World, Nasdaq 100 and S&P 500 Health Care indices from July 2021 – August 2024 |

|

| Source: FE fundinfo, correct as at September 2024. |

This is due to a combination of factors, but it would be difficult to deny the optimism surrounding the recent spate of new technologies and treatments which have entered the market over the last couple of years.

Record innovation piques consumer interest

A hard-to-miss success story in the healthcare sector over the last couple of years has been the new generation of weight-loss drugs. Glucagon-like peptide 1 (GLP-1) agonists - such as Novo Nordisk’s Ozempic and Eli Lilly’s Zepbound – have spurred a flurry of consumer interest and even a Hollywood craze.

These new medications are designed to help regulate blood sugar levels and reduce hunger, and are used primarily to treat obesity and type 2 diabetes. However, ongoing trials are spurning out evidence that these drugs are also effective at preventing and treating a range of other health conditions, including Parkinson’s and Alzheimer’s.

The number of patients which meet the eligibility criteria for these drugs is among the largest of any new drug class to hit the market in the past 20 to 30 years. Analysts at Schroders have predicted GLP-1 sales to reach $6 billion in 2024, with some even speculating that this class of drugs could become the first to reach $100+ billion.

When asked about the potential of these new weight-loss therapies, Trevor Polischuk, Partner of OrbiMed Capital, which manages Worldwide Healthcare Trust, said: “In a word, enormous. The combination of incredible efficacy, long-term safety, and a massive addressable market in terms of global patient prevalence has created the largest therapeutic market opportunity I have ever seen in my career.”

The innovation whirlwind is not only limited to Ozempic and its pharmaceutical cousins. In its half-year report, the Polar Capital Global Healthcare Trust welcomed the sector-wide surge of innovation and highlighted the record number of newly-approved and marketed drugs.

Innovation is the lifeblood of many industries, none more so than healthcare and it appears to be flourishing.

- Polar Capital Global Healthcare Trust Half Year Report, March 2024

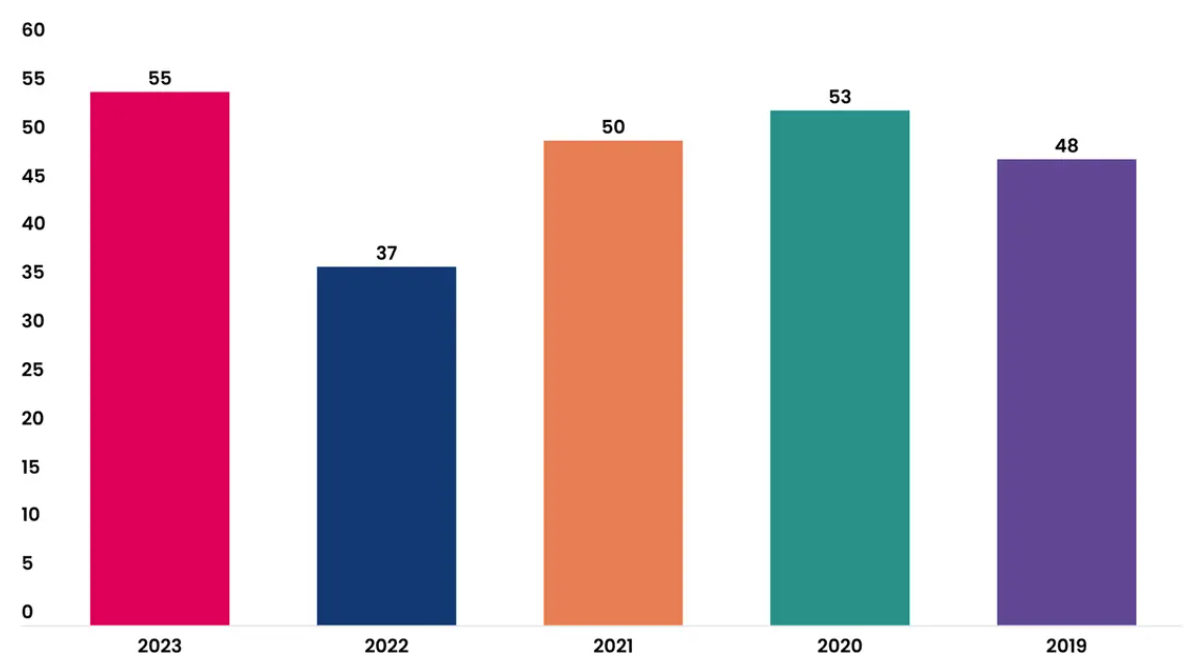

Exhibit 2: 2023 saw a record number of “novel” drugs hit the market Number of “novel” drugs approved by the FDA on an annual basis between 2019 – 2023 |

|

| Source: US Food & Drug Administration, correct as at September 2024. |

Perhaps most impressive of all, however, is that these approvals span across a range of different areas - from infectious disease to opioid abuse to cancer – which have promising commercial implications.

Gareth Powell, Head of Healthcare at Polar Capital and Fund Manager at the Polar Capital Global Healthcare Trust, points out that many of the new releases aim to address the strong demand for novel treatments for chronic conditions “where there is not only a high unmet need but also large, addressable markets”.

“While it is important to recognise and applaud the terrific pace of innovation, it is also essential to focus on the commercial landscape. Obesity, atrial fibrillation (an irregular, often abnormally high, heart rate) and Alzheimer’s disease are all huge markets, but the medical breakthroughs in respiratory diseases are also significant.”

As well as new drug therapies, the field of robotic surgery has also ridden the wave of innovation in the last twelve months. Improved designs and better integration, thanks to higher computing power and novel features such as haptic feedback (motion or vibration to simulate tactile experiences), have helped to streamline surgeons’ workflows and improve patient outcomes.

Meanwhile, the integration of AI has aided diagnostics, where physicians are able to work alongside AI designed to help detect abnormalities. One such example is the colonoscopy - the gold standard test used to identify colorectal cancer – and researchers at the Mayo Clinic who have been trialling using AI to improve polyp detection. The AI system scans the patient in real time alongside the physician and helps to locate polyps which might otherwise be overlooked due to human error.

Other uses of AI in diagnostics include breast and lung cancer screening, where it is used to identify and measure unusual lesions, aiding physicians in reaching a faster and more accurate diagnosis.

In its 2024 Global Health Care Sector Outlook, BlackRock acknowledged that “technological advances in minimally invasive procedures continue to enhance patient outcomes and present attractive investment opportunities”.

Polar Capital’s Powell says these AI-driven innovations are not just passing fancies, but have the potential to fundamentally change the way healthcare is developed and delivered around the world.

“Far from arising as a result of AI-fuelled short-termism as may be seen in other parts of the market, these applications could unlock value within healthcare at a scale we have not seen before. The sheer step-change in accuracy, efficiency and long-term cost reduction presents meaningful potential for compounded progress over the coming years.”

A health insurance revolution on the horizon

While the AI revolution continues to disrupt robotics and diagnostics, another one is brewing in the health insurance market. The WEF stated at the end of 2023 there is an urgent need for transformation in how health insurers articulate and deliver their offerings to customers around the world. This comes amid mounting strain on state-funded solutions and an ageing population increasingly saddled with chronic health problems.

“Traditionally seen as discretionary, complex and uninteresting, health insurance - especially among young people - is poised for a radical transformation,” the WEF says. “We are witnessing a tectonic generational shift – increasingly young individuals are turning away from conventional state-funded health systems (such as the NHS in the UK), opting instead for faster, more effective, high-quality healthcare solutions.”

On this side of the pond, the NHS is grappling with some of the most intense pressures in its 70+ year history. A report by the British Medical Association (BMA) found that more patients than ever are waiting for treatment, with a shocking 7,622,949 individuals stuck on waiting lists as at June 2024. Meanwhile, the BMA estimates that healthcare spending growth has been below average since 2010, resulting in a cumulative underspend of £362 billion.

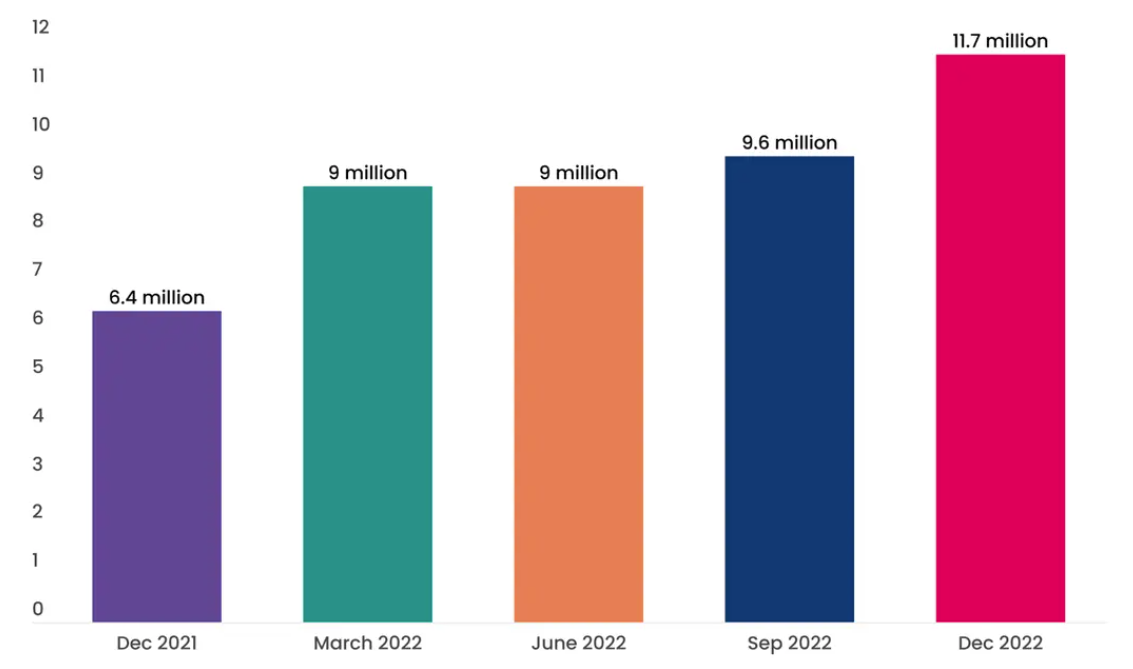

With the NHS stretched to breaking point, more and more Brits are turning to private healthcare to meet their needs. The WEF recorded an impressive 83% growth in the number of insured individuals in the UK between 2021-2022, bringing the total to 11.7 million. This phenomenon has even trickled down to the younger generation, who have historically shown less interest in private healthcare, amid reports from the Office for National Statistics (ONS) that 48% of those aged 16-24 years have expressed dissatisfaction with their current health status.

Exhibit 3: The number of people with health insurance grew by 83% from 2021 to 2022 Number of people in the UK with health insurance between 2021-2022 |

|

| Source: World Economic Forum, correct as at September 2024. |

“This behavioural pivot has triggered a necessity for health insurers to revamp their strategies aimed at this demographic, ensuring their offerings are straightforward, affordable, and attractive,” the WEF says. “This transformation isn't just critical – it's inescapable and will shape the future of health insurance as we know it.”

Over in the United States and a quiet but significant revolution in health insurance practices has been taking place. Intelligence thinktank Clarivate pointed out that the US health insurance market is seeing one of the largest shake-ups in enrolment numbers ever; 2023 marked an all-time high for new customers, while Medicaid enrolment plummeted by nearly 9 million in the six months to January 2024.

Analysts at Fidelity explain that at the core of this movement is a change from a fee-for-service model to a value-based model:

“In the US, a gradual transition has been underway, from a traditional fee-for-service model (in which providers are compensated based on the volume of visits and services they provide) to a value-based model (in which physicians are compensated based on patient outcomes rather than on service volumes).”

This transformation heralds not just a fundamental change for the insurance market, but also an opportunity for firms to capitalise on the long-term shift.

At the start of 2024, the Polar Capital Global Healthcare Trust acknowledged that the transition had put insurers under newfound pressure, with some companies struggling with “rising medical costs due to increased procedure volumes putting pressure on near-term margins and earnings”.

However, a forecast by Mordor Intelligence estimates that the US health insurance market – currently worth around $1.5 trillion – is expected to reach $2.01 trillion by 2029, growing at a compound annual growth rate of greater than 6%. Some health insurance companies could be poised to benefit from this long-term transformation, so long as they are able to pivot accordingly to growing demand and consumer expectations.

Various funds are already exposed to the US healthcare market and so may be well-positioned to profit from the winners in the insurance space. The Polar Capital Global Healthcare Trust, for instance, has 50% of its total assets allocated to the US, according to data from the Association of Investment Companies (AIC).

The forecast for healthcare as we approach 2025

Off the back of all this disruption and momentum, what do the experts think about what lies in store for the healthcare sector? The answer is multi-pronged; The experts believe that performance may be tied to a number of factors, including the outcome of the upcoming US presidential election.

James Douglas, Fund Manager at the Polar Capital Global Healthcare Trust, says that although the result is “incredibly hard to predict”, the most important element for the healthcare sector is how the election impacts Congress.

“Here it seems there is a very low probability that one party will have a significant lead in both the House and the Senate. Therefore, our conclusion for this election is healthcare should continue to do well.”

He maintains that the current environment leaves healthcare stocks in a strong position for the year ahead. Attractive valuations in particular could make for an interesting opportunity, but the expertise of fund managers may be necessary to maximise potential returns. After all, in a sector which spans so many fields – from pharmaceuticals to robotics to insurance – it can be difficult to see the wood for the trees.

“For the first six months of the year, a lack of breadth has characterised markets, with a handful of companies propelling equity indices higher. This trend has been visible also in healthcare, creating a large dispersion between the winners and the losers. This large dislocation offers compelling opportunities and has strengthened our belief that an active management approach to the sector remains key to unlocking such opportunities.”

In terms of the key factors analysts will be looking to over the coming months, Douglas says the team at the Polar Capital Global Healthcare Trust will be keeping an eye on two areas: How markets respond to the ongoing hype around AI, and the general trajectory of the global economy.

“It’s not just drugs, it’s insurance, medical devices, life sciences and tools,” Douglas explains. “It’s a broad spectrum. There is real disruption in the delivery of healthcare.”

Elsewhere, other experts are paying close attention to the mid-to-long-term transformation in US health insurance, as this mammoth and ever-growing market has the potential to sway the performance of healthcare stocks on a global scale.

That being said, Fidelity’s Yoon concedes that the breadth of the overall sector allows it to benefit from both defensive and growth cycles, and that this gives it a unique resilience in the face of uncertainty in the global economy.

“No matter where US markets are headed next, the healthcare sector can offer a combination of defensive and growth characteristics that may be attractive in a variety of scenarios.”

Indeed, Polar Capital’s Gareth Powell concludes that the sector appears to be poised for growth in the near future and could provide an interesting investment opportunity for those looking to capitalise on the trends shaping the future of global healthcare.

“With conviction in the industry’s key growth drivers increasing, especially with regards to innovation and demand, we remain optimistic that the healthcare sector will deliver attractive revenue and earnings growth and generate outperformance in the coming months and years.”